Gold has long been a cornerstone of African economies, serving as both a symbol of wealth and a tangible asset. Historically, regions like the Witwatersrand Basin in South Africa have been prolific gold producers, yielding over 41,000 tons to date. Today, Africa’s vast and largely untapped gold reserves continue to attract investors worldwide. The continent’s relatively low labor and production costs further enhance the profitability of gold mining operations, making African gold an appealing investment for both local and international stakeholders.

Cape Town, in particular, plays a pivotal role in this sector. The city hosts significant events like the 121 Mining Investment conference, which connects mining companies with investors, fostering opportunities within the African gold market. Such gatherings underscore Cape Town’s importance as a hub for mining investment, reflecting the broader trend of increased interest in African gold ventures.

Investing in African gold offers diversification benefits and potential for substantial returns. However, it also requires careful consideration of various factors, including geopolitical dynamics, regulatory environments, and market trends. Understanding these elements is crucial for investors aiming to navigate the complexities of the African gold industry effectively.

Buying Physical Gold: Bullion, Coins, and Jewelry

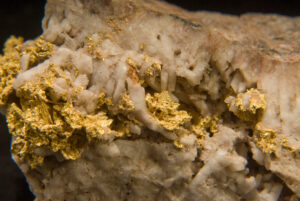

Gold Bullion & Bars

Investing in gold bullion offers a tangible asset with intrinsic value. In Africa, reputable sources for certified gold bars include the Rand Refinery in South Africa, renowned as one of the world’s largest integrated precious metals refining complexes. When purchasing gold bars, it’s crucial to consider purity levels; 24K gold is 99.9% pure, while 22K gold contains 91.67% gold, with the remainder comprising other metals to enhance durability. Ensuring proper certification and authenticity is vital to safeguard your investment.

Gold Coins

Gold coins combine the intrinsic value of gold with potential numismatic appeal. The South African Krugerrand, introduced in 1967, is one of the most traded gold coins globally. Other notable African gold coins include Ghanaian Cedis and Nigerian Mint gold coins. Beyond their gold content, factors such as rarity, condition, and historical significance can influence a coin’s value. For instance, limited edition proof Krugerrands are minted for collectors and often carry a premium over standard bullion coins.

Gold Jewelry as an Investment

Gold jewelry serves both aesthetic and investment purposes. African handcrafted gold jewelry is renowned for its intricate designs and cultural significance. However, when considering jewelry as an investment, it’s essential to be aware that craftsmanship and design intricacies can add premiums above the actual gold value. While these pieces may appreciate over time, their resale value heavily depends on market demand, design appeal, and gold purity. Investors should weigh these factors carefully to ensure alignment with their investment objectives.

Investing in Gold ETFs & Mining Stocks

Gold Exchange-Traded Funds (ETFs)

Gold ETFs provide investors with exposure to gold prices without the need for physical storage. These funds track the performance of gold and are traded on stock exchanges, making them a liquid and accessible investment. In Africa, the Johannesburg Stock Exchange (JSE) offers gold-backed ETFs such as the NewGold ETF, while the Nigerian Stock Exchange (NGX) has introduced gold investment products to attract local investors. Gold ETFs serve as a hedge against inflation and currency volatility, particularly in emerging African economies.

Mining Stocks

Investing in African gold mining stocks offers potential for high returns but comes with market risks. Companies like AngloGold Ashanti, Harmony Gold, and Gold Fields dominate the sector, with operations spanning multiple African countries. Stock prices are influenced by factors such as production levels, operational costs, and political stability in mining regions. For instance, Mali’s recent mining law reforms have affected investor confidence, highlighting the importance of understanding regulatory environments before investing.

Gold Mutual Funds vs. Individual Stocks

Gold mutual funds provide a diversified approach to investing in gold-related assets, reducing risk compared to buying individual mining stocks. These funds pool capital to invest in a range of mining companies, mitigating the impact of any single stock’s volatility. When selecting a fund, investors should assess financial performance, fund management strategies, and historical returns to ensure long-term stability. For those seeking more control, individual mining stocks may offer higher rewards but demand deeper market knowledge.

The Best African Countries for Gold Investment

South Africa: A Traditional Gold Powerhouse

South Africa has historically been one of the world’s top gold producers, with the Witwatersrand Basin accounting for a significant portion of global reserves. Despite declining production, the country remains a key investment destination due to its well-developed mining infrastructure and established regulatory framework. Investment opportunities exist in major gold-producing regions such as Johannesburg and Gauteng, where companies like AngloGold Ashanti and Harmony Gold continue operations. South Africa’s stock exchange also offers gold-backed ETFs, providing alternative investment options for those looking to capitalize on the sector.

Ghana: The Gold Coast of Africa

Ghana has overtaken South Africa as Africa’s top gold producer, benefiting from a stable political climate and investor-friendly policies. The country’s Minerals and Mining Act ensures attractive tax incentives and transparent regulations, making it a preferred destination for foreign investors. Major gold mines, including those operated by Newmont and Gold Fields, continue to expand, driving economic growth. Ghana’s government actively promotes investment in its gold sector, reinforcing its status as a prime market for both industrial-scale and artisanal gold mining.

Mali & Burkina Faso: Emerging Gold Frontiers

Mali and Burkina Faso have seen a surge in gold exploration, with new discoveries attracting international mining firms. Mali, home to mines operated by Barrick Gold and B2Gold, ranks among the top gold producers in Africa. Burkina Faso’s rapidly growing sector has positioned it as a rising player in West Africa’s gold market. However, ongoing political instability and security threats from militant groups pose risks to long-term investment, making due diligence essential for potential investors.

Sudan & Ethiopia: High Risk, High Reward

Sudan holds vast untapped gold reserves, with artisanal and large-scale mining contributing significantly to its economy. Despite its potential, political instability and smuggling issues remain challenges for sustainable investment. Ethiopia, on the other hand, has made strides in modernizing its mining sector, with government-led reforms aimed at attracting foreign capital. Companies like KEFI Gold and Copper are leading exploration efforts, indicating promising opportunities for investors willing to navigate regulatory complexities.

Understanding Gold Price Fluctuations & Economic Factors

International gold prices, influenced by factors like global demand, geopolitical tensions, and economic indicators, directly impact African markets. For instance, during periods of global economic uncertainty, investors often turn to gold as a safe haven, driving up prices. In Africa, currency exchange rates play a significant role in gold investments. A stronger local currency can make gold exports less competitive, while a weaker currency can boost earnings for local miners when revenues are converted from stronger foreign currencies.

Gold has historically served as a hedge against inflation in African economies. During times of currency devaluation, gold prices often rise, preserving purchasing power. For example, in countries experiencing high inflation, citizens may invest in gold to protect their wealth from eroding. This behavior underscores gold’s role as a stable store of value amidst economic fluctuations.

Government policies significantly influence gold trade and investment in Africa. Import and export restrictions, such as those implemented to curb illegal mining activities, can affect the availability and pricing of gold. For instance, Mali suspended artisanal gold mining permits for foreign companies following a series of fatal accidents, impacting gold production and trade. Additionally, tax policies, including royalties and export duties, vary across African nations, presenting both opportunities and challenges for investors. Understanding these regulatory environments is crucial for effective investment strategies in the African gold sector

Risks & Challenges of Investing in African Gold

Fraud & Counterfeit Gold

Verifying gold authenticity is critical to avoiding financial losses. Buyers should insist on purchasing from certified refineries or authorized dealers and request assay certificates to confirm gold purity. Counterfeit gold bars, often filled with tungsten, have surfaced in markets across Africa, emphasizing the need for thorough due diligence. Common scams include bait-and-switch tactics, where buyers receive gold-plated metals instead of solid gold, and fraudulent mining schemes promising unrealistic returns.

Geopolitical Instability

Political conflicts and shifting regulations pose risks to gold investments in several African nations. Mali, Sudan, and the Democratic Republic of Congo have faced disruptions due to government instability, leading to sudden changes in mining laws and operational restrictions. Investors can mitigate these risks by diversifying holdings across multiple countries and staying informed about regulatory developments. Establishing local partnerships and working with reputable firms also reduces exposure to unpredictable policy shifts.

Market Volatility & Liquidity Concerns

Gold prices in Africa are subject to both global market trends and local economic conditions. Short-term volatility can be driven by currency fluctuations, changes in mining output, and international gold demand. Unlike in established financial hubs, selling gold in certain African markets may pose liquidity challenges due to limited access to global trading platforms and fluctuating local demand. Investors must assess market accessibility and exit strategies before committing to large-scale gold investments.

Investing in African gold presents a range of opportunities, from physical gold purchases to mining stocks and ETFs. The right investment choice depends on an individual’s risk tolerance—those seeking stability may prefer gold bullion or ETFs, while higher-risk investors might explore mining stocks in emerging markets. Diversification across multiple gold assets can help balance risk and enhance returns.

Thorough research and verification are essential to avoid pitfalls such as fraudulent schemes, counterfeit gold, and regulatory uncertainties. Investors should source gold from trusted refineries, stay informed about geopolitical developments, and understand the tax and export policies of each gold-producing nation. Partnering with reputable financial institutions or gold investment firms adds an extra layer of security.

Gold remains a resilient long-term asset in Africa’s evolving economy, serving as both a store of value and a hedge against inflation. As global demand for gold grows, Africa’s rich reserves and expanding markets provide strong investment potential. A strategic approach—balancing risk management, diversification, and market awareness—can unlock significant opportunities in the African gold sector.